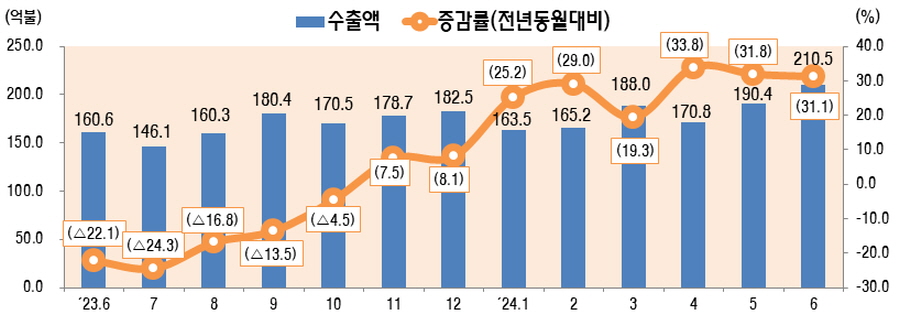

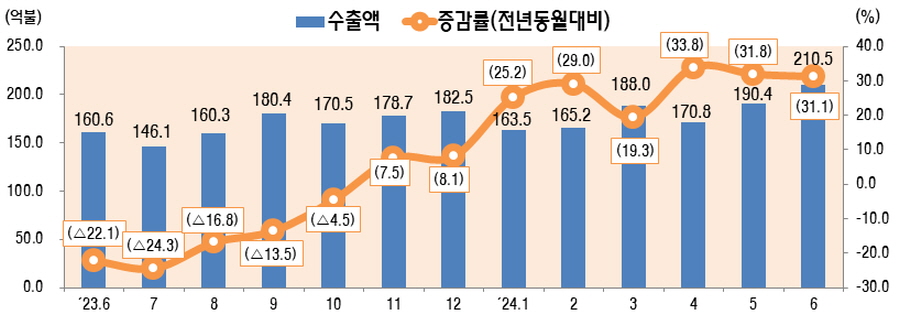

2024년 상반기 및 6월 정보통신산업(ICT) 수출이 반도체 수요 확대 및 판매단가 상승 등에 힘입어 상반기 기준 역대 두 번째, 월 기준 역대 최대의 수출 성과를 거뒀다. 상반기 수출은 전년대비 28.2% 증가한 1,088억5,000만달러를 기록했고, 수입은 0.7% 감소한 677억8,000만달러를 기록해 410억7,000만달러의 무역수지 흑자를 기록했다.

▲최근 월별 정보통신산업(ICT) 수출 추이(억불, %, 전년동월대비)

상반기 ICT 수출 1,089억불 전년比 28% ↑

6월 수출 211억불 전년比 31% ↑, 역대 최대

2024년 상반기 및 6월 정보통신산업(ICT) 수출이 반도체 수요 확대 및 판매단가 상승 등에 힘입어 상반기 기준 역대 두 번째, 월 기준 역대 최대의 수출 성과를 거뒀다.

정부가 최근 발표한 2024년 상반기 및 6월 정보통신산업(ICT) 수출입 동향에 따르면 상반기 수출은 전년대비 28.2% 증가한 1,088억5,000만달러를 기록했고, 수입은 0.7% 감소한 677억8,000만달러를 기록해 410억7,000만달러의 무역수지 흑자를 기록했다.

상반기 ICT 수출은 주력 수출 품목인 반도체가 수요 확대, 판매단가 상승 등으로 크게 증가해 전체 ICT 수출의 성장을 주도하면서 2024년 1월부터 6개월 연속 두 자릿수 증가하는 등 수출 호조세를 지속하고 있다.

품목별로는 반도체가 658억3,000만달러로 전년대비 49.9% 증가했다. 인공지능 시장 성장, IT 기기 시장 회복 등에 따른 반도체 수요가 확대됐고, 메모리는 고정 거래가격 상승 및 인공지능 시장 수요에 따른 HBM 등 고사양 메모리 품목의 수출 확대로 전체 수출을 견인했다.

디스플레이는 101억달러로 전년대비 14.6% 증가했다. TV·PC 등 IT 기기 수요 회복세 및 차량 등의 패널 적용 확대 양상으로 디스플레이 수출은 두 자릿수 증가했다.

휴대폰은 55억8,000만달러로 전년대비 2.8% 감소했다. 휴대폰 부분품(카메라모듈 등) 수출의 주 수요처인 중국(홍콩 포함)의 수요 부진으로 1분기 감소했으나, 2분기부터 플러스 전환하며 상반기 감소폭을 축소했다.

컴퓨터 및 주변기기는 59억9,000만달러로 전년대비 35.6% 증가했다. 서버·데이터센터 투자 확대 및 PC 등 기기 수요가 증가했고, 특히 IT 업황의 개선에 따라 보조기억장치인 SSD의 수요가 크게 증가하며 전체 컴퓨터·주변기기 수출을 확대했다.

통신장비는 11억9,000만달러로 전년대비 2.9% 감소했다.

지역별로는 중국은 474억3,000만달러로 전년대비 37.3% 증가했고, 베트남은 173억2,000만달러로 전년대비 21.7% 증가했다. 미국은 125억9,000만달럴로 전년대비 19.2% 증가했고, 유럽연합은 59억6,000만달러로 전년대비 8.2% 증가했다. 일본은 18억5,000만달러로 전년대비 9.3% 감소했다.

한편 6월 ICT 수출은 210억5,000만달러로 전년동월대비 31.1% 증가했고, 수입은 108억7,000만달러를 기록하며 101억8,000만달러의 무역수지 흑자를 기록했다.

품목별로는 반도체가 134억4,000만달러로 전년동월대비 49.4% 증가했다. 인공지능(AI) 시장 성장, IT기기 시장 회복 등에 따른 반도체 수요 확대 등으로 전체 반도체 수출은 역대 최대 실적을 갱신했다.

디스플레이는 19억5,000만달러로 전년동월대비 22.6% 증가했다. TV·PC 등 IT 기기 수요 회복세로 유기발광다이오드(OLED) 및 액정디스플레이(LCD) 동시 증가하며 전체 디스플레이 수출은 5개월 연속 두 자릿수 증가했다.

휴대폰은 8억4,000만달러로 전년동월대비 8% 증가했고, 컴퓨터 및 주변기기는 12억9,000만달러로 전년동월대비 48.9% 증가했다. 동신장비는 2억달러로 전년동월대비 8.6% 감소했다.

지역별로는 중국이 87억1,000만달러로 전년동월대비 29.2% 증가했고, 베트남이 34억달러로 전년동월대비 36.8% 증가했다. 미국이 25억달러로 전년동월대비 27% 증가했고, 유럽연합이 9억9,000만달러로 전년동월대비 1.5% 증가했다. 일본은 3억3,000만달러로 전년동월대비 8.6% 감소했다.