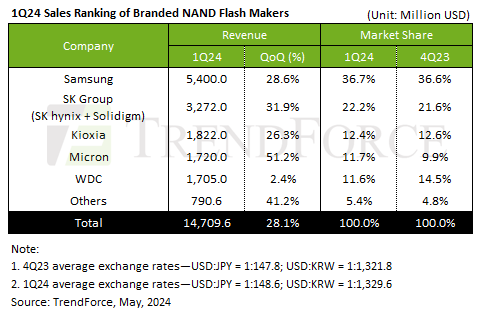

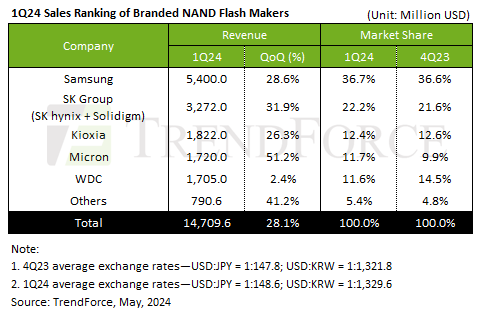

▲2024년 1분기 낸드플래시 시장 점유율 / (자료:트렌드포스)

삼성·SK 쌍두마차 낸드 시장 과반 점유

낸드 매출 QoQ 두자릿수 증가·ASP 상승

반도체 수요가 회복되면서 매출 회복이 더디던 낸드플래시 시장도 다시금 활기를 뛰기 시작했다.

글로벌 시장조사기관 트렌드포스에 따르면 2024년 1분기 낸드플래시 가격과 출하량이 상승해 분기 매출이 28.1% 증가한 147억1,000만달러(한화로 약 20조원)를 기록했다고 밝혔다.

트렌드포스는 AI 서버의 엔터프라이즈 SSD 채택이 2월부터 시작돼 이후 낸드플래시의 대규모 주문이 발생했다고 보고했다. 또한, PC와 스마트폰 고객들은 가격 상승을 관리하기 위해 재고 수준을 늘려 온 것으로 나타났다.

2024년 1분기 낸드플래시 시장 점유율은 △삼성전자 36.7% △SK그룹(하이닉스+솔리다임) 22.2% △키옥시아 12.4% △마이크론 11.7% △WDC 11.6% △기타 5.4% 순으로 나타났다.

삼성전자는 고객사의 지속적인 재고 축적과 기업용 SSD 주문 회복에 힘입어 전분기 대비 28.6% 성장한 54억달러의 매출 성적을 기록했다. 이에 업계 선두 자리를 유지했다. 트렌드포스는 낸드플래시 계약 가격 상승으로 인해 2분기 삼성의 매출이 20% 이상 성장할 것으로 전망했다.

SK그룹은 스마트폰과 서버 주문 호조에 힙입어 1분기 매출이 전분기 대비 31.9% 증가한 32억7,000만달러를 기록했다. 솔리다임의 플로팅 게이트 QLC 아키텍처는 고용량 기업 SSD에 대한 수요를 유지하는 데 도움이 됐다는 평이다. SK그룹의 2분기 출하량 증가율은 다른 공급업체를 앞지르며 매출이 약 20% 증가할 것으로 예상했다.

키옥시아의 1분기 생산량은 지난 분기 생산량 감축의 영향을 받아 출하량이 QoQ 7% 소폭 증가했다. 더불어 낸드플래시 가격 상승으로 전분기 대비 26.3% 증가한 18억2,000만달러의 매출 성적표를 받아들었다. 키옥시아는 공급 비트 증가와 보다 유연한 가격 책정으로 인해 2분기 매출이 약 20% 증가할 것으로 예상되며, 이로 인해 엔터프라이즈 SSD 출하량이 더욱 확대될 것으로 보인다.

웨스턴디지털의 1분기 출하량은 2월부터 시작된 소매 시장 수요의 급격한 감소에 영향을 받았다. 다만 낸드플래시 고정 가격 상승으로 매출은 전분기 대비 2.4% 증가한 17억1,000만달러를 기록했다.

PC와 스마트폰 부문에 대한 불안정한 시장 전망에도 불구하고, 웨스턴디지털은 미래 성장을 주도하기 위해 기업용 SSD 제품 개발을 강화할 계획이다. 다만 기업용 제품의 검증 시간이 길어지면서 단기 출하량 증가는 제한되고, 2분기 매출은 정체될 것으로 예상되고 있다.

PC와 스마트폰 고객사들은 이미 2분기에 NAND 플래시 재고 수준을 높인 것으로 전해진다. 브랜드 제조업체로부터 보다 보수적인 구매로 이어지고 있는 상황이다.

한편, 대기업용 SSD 주문이 급증하면서 낸드플래시의 ASP는 15% 상승했다. 트렌드포스는 2분기 낸드플래시 매출이 지난 분기 대비 약 10% 증가할 것으로 예상했다.