삼성전자가 2024년 연간 실적에서 역대 두 번째인 300조 매출 달성에도 불구하고, 반도체 영업익에서 SK하이닉스에 뒤지며 웃지를 못했다. 삼성전자가 31일 공시한 2024년 4분기 경영실적에 따르면 연결재무제표 기준으로 매출 300조8,709억원으로 기록해 전년대비 16.2% 증가했고, 영업이익은 32조7,260억원을 기록해 전년대비 398.3% 증가했다. 당기순이익은 34조4,514억원을 기록해 전년대비 122.5% 증가했다.

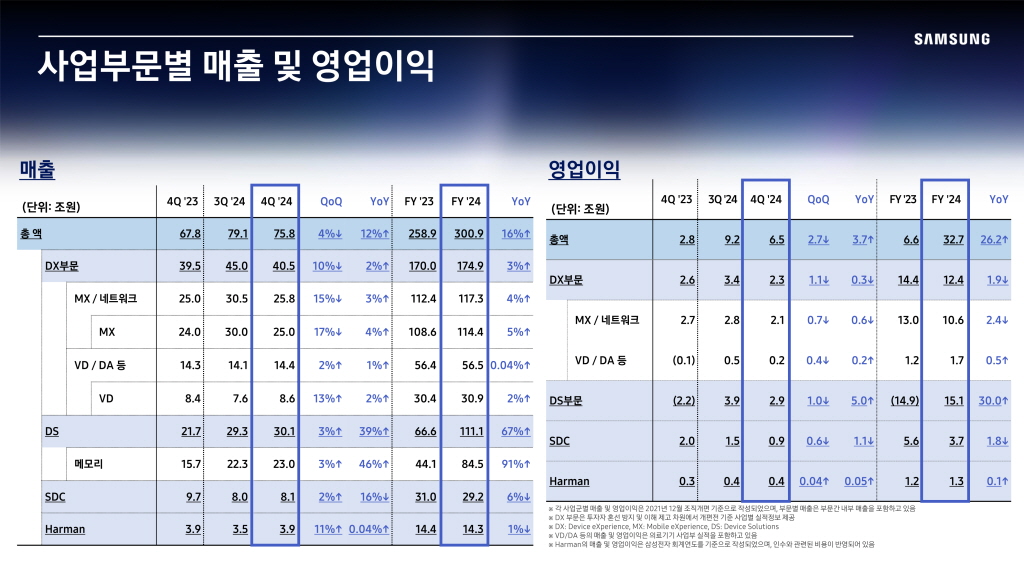

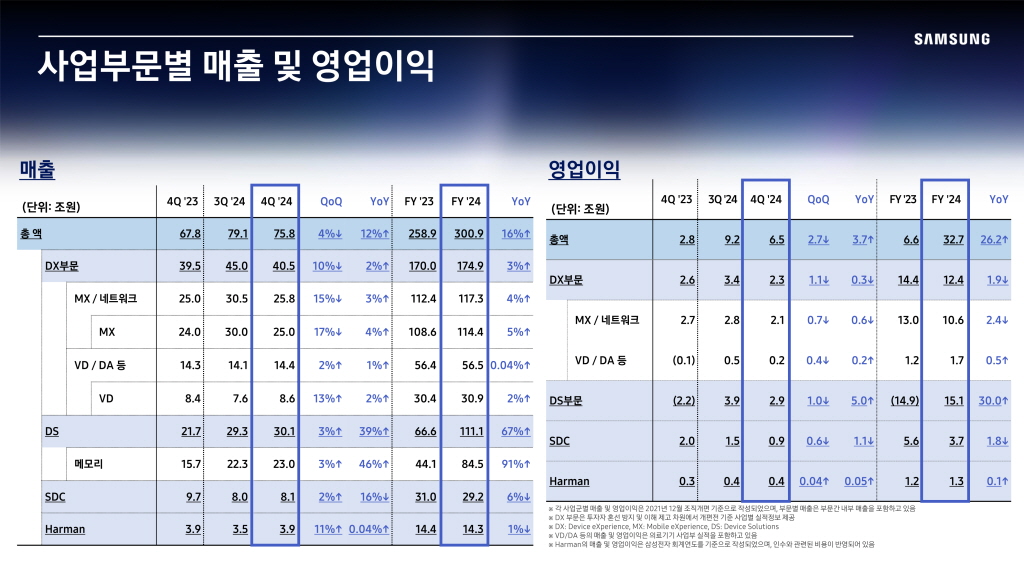

▲삼성전자 2024년 연간 및 4분기 사업부문별 매출 및 영업이익(자료 : 삼성전자)

매출 300조8,709억 전년比 16% ↑, 영업익 32조7,260억

반도체 부문 2024년 매출 111조1천억·영업익 15조1천억

삼성전자가 2024년 연간 실적에서 역대 두 번째인 300조 매출 달성에도 불구하고, 반도체 영업익에서 SK하이닉스에 뒤지며 웃지를 못했다.

삼성전자는 31일 2024년 4분기 경영실적을 공시했다.

이에 따르면 2024년 연간 경영실적은 연결재무제표 기준으로 매출은 300조8,709억원으로 기록해 전년대비 16.2% 증가했고, 영업이익은 32조7,260억원을 기록해 전년대비 398.3% 증가했다. 당기순이익은 34조4,514억원을 기록해 전년대비 122.5% 증가했다.

관심을 모은 DS부문(舊 반도체)은 매출 111조1,000억원, 영업이익 15조1,000억원을 기록했다.

고부가 반도체 등으로 경쟁을 지속하고 있는 SK하이닉스가 2024년 매출 66조1,930억원, 영업이익 23조4,673억원을 거둔 것과 비교하면, 삼성전자의 2024년 반도체 경영실적이 높은 매출에도 불구하고, 오히려 적은 영업이익을 거둔 것으로 나타나며, HBM 등 고부가반도체 등에서 부진한 실적흐름을 보인 것으로 분석되고 있다.

2024년 4분기 경영실적은 연결재무제표 기준으로 매출은 75조7,883억원을 기록해 전년동기대비 11.8% 증가했고, 영업이익은 6조4,927억원으로 전년동기대비 129.9% 증가했다. 당기순이익은 7조7,544억원으로 전년동기대비 22.2% 증가했다.

DS(Device Solutions)부문은 4분기 매출 30조1,000억원, 영업이익 2조9,000억원으로 서버용 고부가가치 메모리 제품의 판매 확대로 전분기대비 3% 증가했다.

DX(Device eXperience)부문은 매출 40조5,000억원, 영업이익 2조3,000억원을 기록하며 스마트폰 신모델 출시 효과 감소로 전분기대비 10% 감소했다.

하만은 4분기 매출 3조9,000억원, 영업이익 4,000억원을 기록했고, SDC는 4분기 매출 8조1,000억원, 영업이익 9,000억원을 기록했다.

4분기 시설투자는 전분기 대비 5조4,000억원 증가한 17조8,000억원으로 사업별로는 DS 16조원, 디스플레이 1조원 수준이다.

연간 시설투자 금액은 역대 최대인 53조6,000억원이며 DS 46조3,000억원, 디스플레이 4조8,000억원이 투자됐다.

메모리는 미래 기술 리더십 확보를 위한 연구개발비 집행과 HBM 등 첨단 공정 생산능력 확대를 위한 투자를 지속해 지난 분기 및 연간 대비 투자가 모두 증가했다.

파운드리는 시황 악화로 전년 대비 연간 투자 규모가 감소했다.

디스플레이는 중소형 디스플레이를 중심으로 경쟁력 우위 확보를 위한 투자를 지속하며 전년 대비 연간 투자 규모가 증가했다.

2025년은 AI 분야의 기술 및 제품 경쟁력 강화를 추진하고, 고부가가치 제품의 수요 대응과 프리미엄 제품 판매를 확대할 계획이다.

DS부문은 상반기에 약세가 지속될 것으로 예상되는 가운데, 중장기 경쟁력 강화와 고용량·고사양 제품의 포트폴리오 구축을 추진해 나갈 계획이다.

MX는 갤럭시 S25 시리즈의 출시를 통해 차별화된 AI 경험으로 모바일 AI 리더십을 공고히 하고 폴더블은 S25의 AI 경험을 최적화하고 라인업을 강화해 판매를 확대할 방침이다.