마지막 기사에서는 사용후 배터리 산업의 가치와 중요성을 되짚어보고, 사용후 배터리 산업을 통해 진정한 순환경제 활성화를 달성하기 위한 개선점과 정책 지원에 대해 알아본다.

사용후 배터리 산업이 가져올 지속 가능한 미래…“친환경·경제성 고려한 종합적 정책 지원 따라야”

배터리 산업 원료 공급망 대한 글로벌 규제에 선제적 대응

배터리 전주기 탄소발자국 산정기법 및 평가체계 마련

범부처 거버넌스 및 국제표준·인증 등 글로벌 협력 강화

배터리 안전 진단·해체 등에 필요한 배터리 필수 정보 제공 확대

목차

1) 친환경성·핵심광물 해외 의존도 탈피에 큰 가치

2) 전기차 인기 ↓…사용후 배터리 시장 전망은 어떠한가

3) 우리나라 사용후 배터리 산업 플레이어·기술 현황(1)

4) 우리나라 사용후 배터리 산업 플레이어·기술 현황(2)

5) LFP 배터리 재활용 必…금전적 가치만 고려해선 안 된다

6) 사용후 배터리 산업이 앞으로 나아가야 할 길

[편집자주] 2040년 전기차 폐차 대수가 4,000만대 넘어설 것으로 전망되며 전기차 전주기 탄소발자국의 약 30%를 차지하고, 전기차 가격의 30% 이상을 차지하는 배터리의 재활용 기술은 경제성 부문에서 매우 중요한 기술로 꼽힌다. 사용후 배터리를 재사용·재활용하지 않으면 폐기물이 지속 증가하게 되며, 적절한 처리를 거치지 않고 방치하거나 매립·소각할 경우 유해물질이 발생하여 환경오염을 유발할 수 있다. 친환경성을 매우 중요하게 생각하는 유럽의 CRMA, 미국의 IRA 등에 대응해야 하는 흐름 상 폐배터리 재활용 시장 규모는 계속해서 확대될 것으로 보인다. 이와 같이 경제성, 친환경성을 모두 아우르는 사용후 배터리 산업에 대해 자세히 알아보고, 우리나라 기업들의 기술 및 사업 현황과 산업 전망까지 4월24일부터 매주 수요일, 6주에 걸쳐 기사에 담아낸다.

앞선 다섯 편의 연재기획 기사를 통해 우리는 사용후 배터리 산업의 중요성부터 LFP 배터리 재활용의 필요성까지 다루었다.

친환경성과 경제성을 모두 아우르는 이 산업은 지속 가능한 미래로의 핵심 축으로 자리매김하고 있다.

마지막 기사에서는 사용후 배터리 산업의 가치와 중요성을 되짚어보고, 사용후 배터리 산업을 통해 진정한 순환경제 활성화를 달성하기 위한 개선점과 정책 지원에 대해 알아본다.

배터리 3사, 현대차 등이 참여 중인 배터리 얼라이언스는 사용후 배터리를 ‘폐기물’이 아닌 ‘전기차에서 분리되어 재제조, 재사용, 재활용 대상이 되는 배터리’로 새롭게 정의하고 있다.

사용후 배터리는 셀 일부를 수리 및 교체한 후 자동차에 탑재하거나(재제조), 에너지 저장장치 등으로 용도 전환이 가능해(재사용) 충분한 환경적, 경제적 가치를 갖고 있기 때문이다.

우리 사회는 2015년 파리기후변화협약(파리협정)을 통해 2100년에 지구 온도 상승폭을 1.5℃를 넘지 않도록 온실가스 감축에 나섰다.

탄소배출의 큰 부분을 차지하는 수송 부문에서도 큰 비중을 차지하는 도로부분(우리나라 기준96.5%)에서 전기차는 탄소배출 감소의 혁신을 가져오고 있다.

전기차가 탄소배출에서 완전히 자유로운 것은 아니다.

현대자동차그룹의 2022년 지속가능보고서에 따르면 전과정 단계별 지구온난화 영향에서 아이오닉5 모델의 경우 총 온실가스배출량 169 gCO2-eq/km 중 ‘제조 전 단계’가 27.78%를 차지한다.

‘제조 전 단계’에 해당되는 배터리 원자재 채굴 및 가공에서의 에너지 소모와 환경 영향을 줄이기 위해 배터리 재활용 및 재사용은 필수적인 기술이다.

또한 사용후 배터리 산업은 친환경적인 면 이외에도 공급망 관련 자원 안보 측면에서도 큰 의의를 지닌다.

자원이 나지 않는 우리나라에서 공급망 리스크와 자원 무기화에 대응하기 위한 하나의 방법인 것이다.

손정수 한국지질자원연구원 책임연구원은 본지와의 인터뷰를 통해 배터리 산업에서 강점을 보이고 있는 우리나라가 진정한 강국으로 거듭나기 위해서는 자원 수입 의존도를 낮춰야 하며, 사용후 배터리 재활용이 그 역할을 할 수 있다고 강조했다.

조지혜 선임연구위원 또한 자원 안보와 관련해 물질 재활용을 통해 확보한 재생원료로 희유금속을 대체해 나갈 수 있어 보다 지속가능한 원료 공급망 확보에 기여할 수 있다고 전했다.

우리나라는 광물수요의 95%를 해외수입에 의존하고 있으며 이차전지 양극재의 경우 2021년 기준 우리나라의 대중 수입의존도는 89%에 달했다.

배터리에 들어가는 광물은 유한하며, 편재성을 띄고 있다.

지난해 러시아, 우크라이나 전쟁으로 인한 니켈 가격의 변동성 위험 등 한치 앞을 알 수 없는 국제 정세에 있어 편재성과 높은 해외 의존도는 배터리 산업에 큰 위기로 다가올 수 있다.

LG에너지솔루션은 2024년 1분기 영업이익이 1,573억원으로 지난해 대비 53.5% 감소했다고 밝혔다.

이창실 LG에너지솔루션 부사장은 “손익이 시장 수요 위축에 따른 가동률 조정 등 고정비 부담 증가, 메탈가 하락으로 인한 원재료 투입 시차(Lagging) 효과에 따라 전분기 대비 하락했다”고 보도자료를 통해 알리기도 했다.

세계에서 손에 꼽히는 배터리 제조기업 또한 메탈가 하락의 이유로 영업이익이 좌우될 수 있다고 해석되며, 재활용 등을 통한 원료 확보가 제조 기업의 수익에 자그마한 안정감을 불어넣을 수 있을 것으로 보인다.

우리나라 배터리 3사의 주력 제품인 NCM 배터리뿐만 아니라 LFP 배터리의 재활용도 함께 고려되어야 한다.

LFP 배터리는 2030년까지 수요가 3,000GWh를 초과하여 글로벌 고정식 에너지 저장 시장을 지배할 것으로 전망되고 있다.

NCM에 비해 재활용 시 낮은 수익성과 높은 회수비용 때문에 순환경제로 이어질 수 있을지에 대한 의문은 여전히 남아있는 것은 사실이다.

그럼에도 LFP 배터리의 지속 가능한 재활용은 환경에 미치는 영향을 최소화하면서 리튬, 인, 흑연 등 중요 원자재의 안전한 공급을 보장할 수 있기에 반드시 뒤따라야 한다.

이익을 창출해 내야 하는 기업의 입장에서는 금전적 가치가 낮은 LFP 배터리의 재활용이 매력적이지 않을 수 있으나 친환경성에서는 반드시 필요하다.

김필수 대림대학교 미래자동차학부 교수는 본지에 송고한 칼럼에서 배터리 리사이클링을 하지 않는 LFP 배터리는 차량 당 약 500Kg의 배터리가 분리되는 만큼 심각한 환경성 문제가 발생할 수 있다고 전했다.

조지혜 한국환경연구원 선임연구위원도 본지와의 인터뷰에서 “LFP 배터리는 차량뿐만 아니라 전기 자전거 및 전기 스쿠터, 가전 제품 등 응용분야가 확대되고 있으며, 여기에는 리튬, 인 등의 중요 원자재가 포함되어 있다. 한편, 매립 등 부적정 처리될 경우 환경오염을 초래할 수 있다”며 “앞으로 순환경제 측면에서 발생량 전망에 기반한 회수 및 자원순환 체계 도입 연구를 통해 순환이용을 높여 나갈 필요가 있다”고 전했다.

KDB미래전략연구소 산업기술리서치센터 이선화 선임연구원의 ‘국내 전기차 사용후 배터리 산업 현황과 의미’ 보고서에 따르면 전기차 사용후 배터리 시장의 주도권을 확보하기 위한 투자가 활발하게 진행되고 있으며 국내 주요 기업들을 중심으로 시장 선점을 위해 M&A, Joint Venture, 계열사나 외부 기업 간 협력 등을 통해 사용 후 배터리 산업의 밸류체인 완성을 시도하고 있다.

또한 재활용의 경우 원료확보를 위해 국내뿐만 아니라 해외 네트워크의 구축 및 활용이 필요하여 해당 기능의 해외기업과의 협력이 증가하는 추세이며 재사용 재제조하여 사용된 배터리는 결국 재활용으로 최종 처리되어야 하는 구조상 재활용 분야 기업과의 협업까지 확대되는 상황이다.

손정수 한국지질자원연구원 책임연구원은 지난해 9월 일산 킨텍스에서 열린 K-BATTERY SHOW 2023에서 한국EV기술인협회과 주관한 컨퍼런스에 연사로 나서 “폐배터리 사업 전망은 모든 기업에서 주목하고, 투자도 이어 나가고 있는 반면 아직 그 누구도 시장을 재패하지 못했다”고 말한 바 있다.

이제 떠오르기 시작한 산업이며 앞으로 펼쳐질 기회와 발전될 수 있는 잠재력이 풍부하다는 의미다.

빠른 시장 가치 상승, 기술 발전과 함께 성장통도 존재할 수 있다는 뜻이다.

사용후 배터리 산업을 통한 순환경제 활성화를 위해서는 개선되어야 할 점도 분명 존재하며 뒷받침할 정책도 반드시 뒤따라야 한다.

친환경성과 경제성을 모두 고려한 종합적인 정책 지원과 혁신적인 기술 개발을 통해 사용후 배터리 산업이 지속 가능한 미래를 여는 데 중요한 역할을 할 수 있도록 노력해야 한다.

조지혜 한국환경연구원 선임연구위원은 국내 배터리 순환경제 활성화를 위한 중점 정책과제에 대한 질문에 “배터리 산업의 환경영향 및 원료 공급망에 대한 글로벌 규제에 선제적으로 대응해야 한다”며 “배터리 전주기 탄소발자국 산정기법 및 평가체계를 마련하고, 범부처 거버넌스 및 국제표준·인증 등 글로벌 협력도 강화해야 한다”고 답했다.

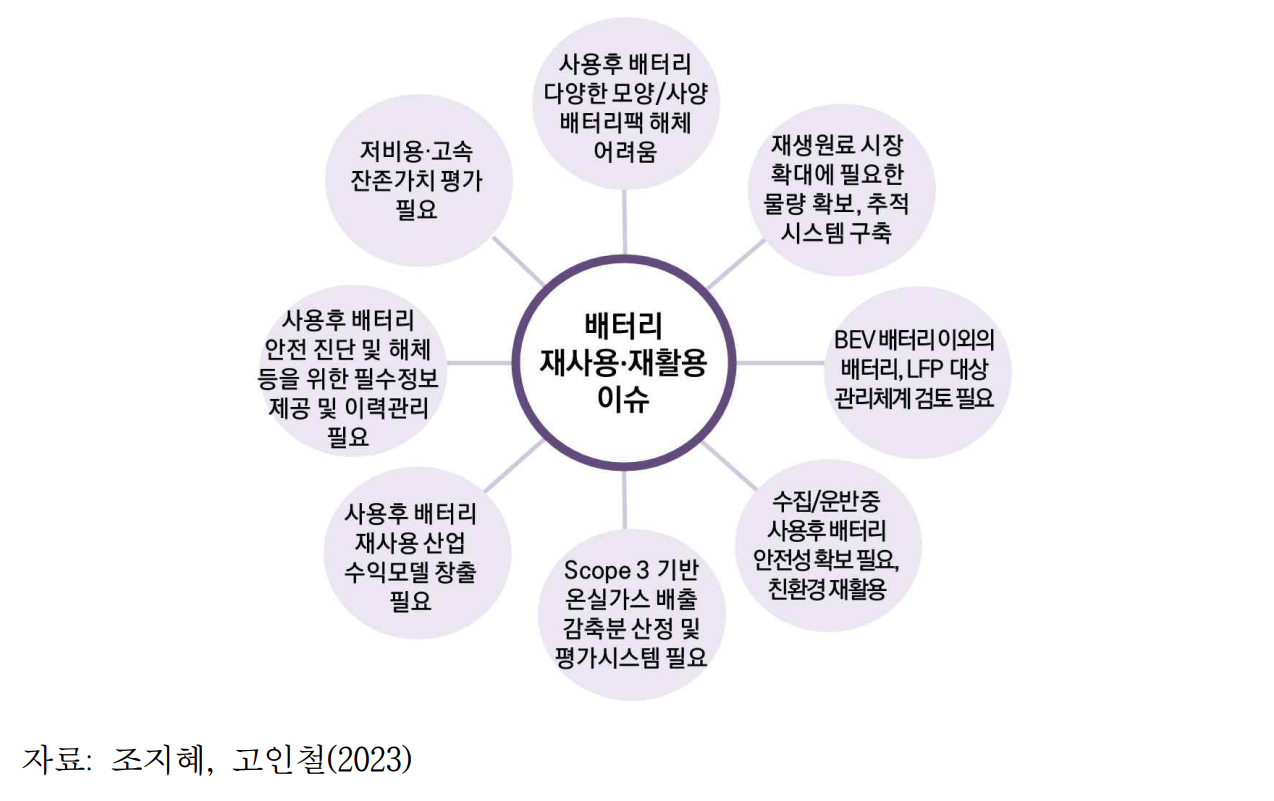

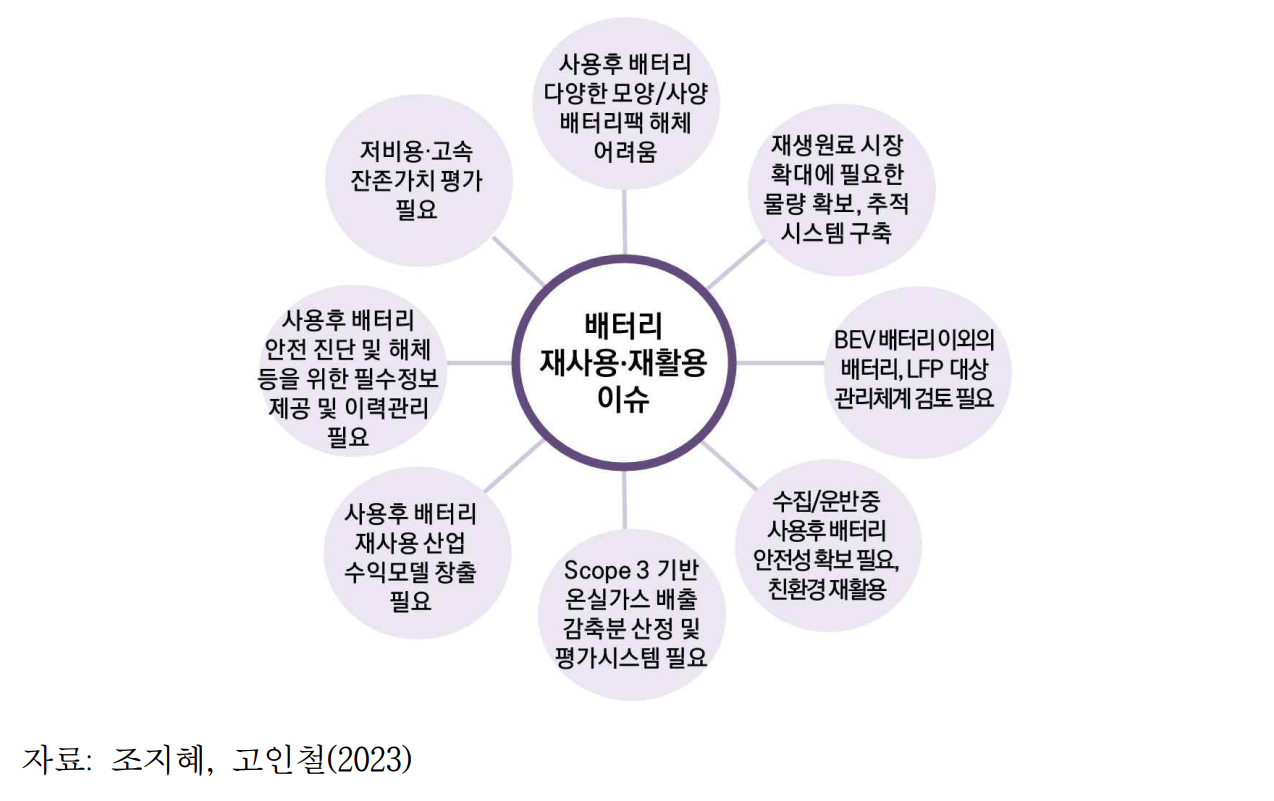

▲배터리 재사용·재활용 이슈(그림 제공: 조지혜 한국환경연구원 선임연구위원)

또한 사용 후 배터리의 다양한 모양 및 사양으로 인한 해체 및 재활용 비용이 상승하는 문제점이도출되기도 하여 ‘순환경제사회 전환 촉진법’ 제16조(순환원료의 사용 촉진) 및 제17조(제품등의순환이용 촉진)과 연계하여 ‘지속가능한 배터리 제품 설계’를 지원할 필요가 있다고 덧붙였다.

화재·폭발 등 안전관리를 위한 방전 방법 등 사용후 배터리 안전 진단 및 해체 등에 필요한 배터리 필수 정보 제공 또한 확대되어야 한다.

재활용을 위한 물량 확보를 위해서는 수출입시 동의 등 절차 관련하여 각 수출입국이 사용후 배터리를 폐기물로 인식하는지에 대한 정보 파악을 통한 지원도 이루어져야 한다.

우리나라도 지난해 12월이 되어서야 사용후 배터리를 폐기물이 아닌 재활용할 수 있는 제품으로 인정하기 시작한 만큼 국가마다 상이한 기준에 대한 모니터링은 필수다.

유럽은 재생원료 사용 의무를 부여하고 전기차 배터리 제조에 사용되는 물질 중 코발트, 납, 리튬, 니켈을 대상으로 신제품 제조 시 재생원료 필수 함유 기준을 설정했다.

규정 발효 후 8년 후부터 배터리 제조 시 투입되는 코발트 16%, 납 85%, 리튬 6%, 니켈 6% 이상의 재생원료를 활용해야 한다.

13년 후부터는 코발트 26%, 납 85%, 리튬 12%, 니켈 15% 이상 재생원료를 활용하도록 규정했다.

위와 같은 규정을 만족할 수 있도록 적극적인 지원이 필요하며, 우리나라에 불리한 규정일 경우 정부는 기업의 의견을 귀 기울여 듣고 유예 혹은 완화할 수 있도록 긴밀한 관계를 유지해 나가야 한다.

앞선 연재기획 기사에서 다루었듯이 우리나라는 많은 기업과 기관들의 활발한 연구와 정책지원 등을 바탕으로 사용후 배터리 산업에서 세계적인 모범이 될 수 있는 잠재력을 지니고 있다.

혁신적인 기술 개발과 함께 효율적인 정책 지원이 어우러져 잠재력을 활짝 피우기를 기대한다.