SDV(Software Defined Vehicle, 소프트웨어 정의 차량)로의 전환은 새로운 형태의 자동차의 등장의 개념을 넘어 자동차 산업의 대전환을 불러일으킬 것이며 새로운 시대에 맞는 선제적인 준비가 필요하다는 전문가의 발표가 이어졌다.

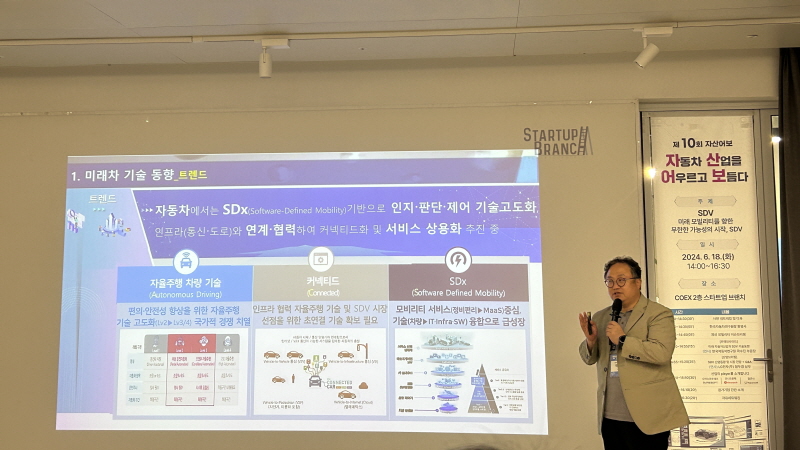

▲곽수진 한국자동차연구원(이하 한자연) 빅데이터·SW기술부문장이 발표하고 있다

車 BOM 비용서 소프트웨어 비율 10% → 2030년 50%로 급증

부품 기업 입지 흔들…자체 소프트웨어 개발 이익 상당 부분 감소 전망

SDV(Software Defined Vehicle, 소프트웨어 정의 차량)로의 전환은 새로운 형태의 자동차의 등장의 개념을 넘어 자동차 산업의 대전환을 불러일으킬 것이며 새로운 시대에 맞는 선제적인 준비가 필요하다는 전문가의 발표가 이어졌다.

곽수진 한국자동차연구원 빅데이터·SW기술부문장은 지난 18일 한자연이 SDV을 주제로 개최한 제10회 자산어보에서 ‘미래 자동차 산업과 SDV 기술동향’에 대해 발표했다.

SDV란 소프트웨어가 주행 성능, 안전 및 편의 기능 등을 담당하는 하드웨어를 제어하고 관장하는 자동차를 뜻한다.

SDV로 인한 소프트웨어 표준화와 규격화를 통해 재사용성, 범용성, 확장성을 확보할 수 있고, 이는 개발 비용을 연 160억달러 가까이 절감할 수 있는 상당한 효과도 불러올 것으로 전망된다.

딜로이트는 차량 BOM 비용에서 소프트웨어가 차지하는 비용이 현재 전체 10%에 불과하나 SDV(Software Defined Vehicle, 소프트웨어 정의 차량) 흐름을 타고 2030년 50%까지 증가할 것이라는 분석도 내놓았다.

완성차 업체들도 소프트웨어 인력 확보에 적극적으로 나서고 있다.

곽 부문장의 발표자료에 따르면 폭스바겐은 기존 4,000명에서 10,000명으로 2.5배, 다임러는 1,000명을 신규채용했으며, 도요타는 신규채용의 50%가 소프트웨어 관련 인력이다.

SDV의 가장 큰 차별점은 △차량 하드웨어에 종속되어 있는 소프트웨어가 각각 분리된다는 점과 △기존 차량은 출시 이후 기능과 성능이 고정되어 있었다면, SDV는 차량 기능의 동적인 추가, 수정, 제거가 가능하다는 것이다.

즉, 소프트웨어 맞춤형 차량의 등장과 차량 기능 및 서비스를 공급하는 서드 파티가 생태계를 좌우할 것이라는 뜻이다.

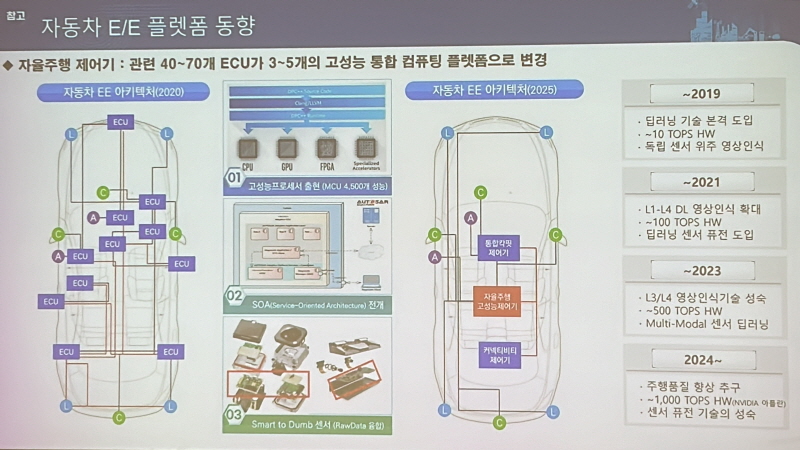

SDV로의 진화는 차량 아키텍처의 변화도 불러일으키고 있다.

현재 차량들은 기능영역기반 설계구조를 바탕으로 파워트레인, 섀시 등 기능별로 다양한 도메인을 구성하여 제어되고 있으며, 이는 영역별로 고성능 반도체화 수많은 ECU를 필요로 한다.

SDV의 유망한 사업성에 따라 OEM들은 컴퓨터와 스마트폰과 같이 OS를 통해 중앙에서 각각의 하드웨어와 개별 소프트웨어를 제어할 수 있는 환경을 구축하려는 움직임을 보이고 있다.

이를 실현시키기 위해서는 쉽게 결합, 확장이 가능한 소프트웨어 아키텍처가 뒤따라야 하며 중앙집중식 E/E 아키텍처 형태로 변화할 것으로 보인다.

현재 자동차는 동력계에 40여개, 섀시 20여개, 안전/ADAS 50여개, 바디/편의 80여개의 전장부품이 탑재되며 각각 4개, 5개, 11개, 26개의 개별제어기로 작동되는데, SDV로 나아갈 경우 전체적인 큰 영역을 통합하는 통합 제어기 3 ~ 5개, 영역 제어기 3 ~ 5개로 간소화될 것으로 업계는 예상하고 있다.

차량용 OS도 화두다.

곽 부문장은 차량용 OS를 어떤 기업이 점유하냐에 따라 생태계가 급변할 수 있다고 전했다.

△OEM이 주도하여 SDV OS 생태계 모델을 주도할 경우 각 OEM들이 각각의 OS로 사업을 진행하여 소프트웨어 생태계를 꾸려 나가는 경우 △애플, 구글처럼 기존 서비스 생태계를 갖고 있는 기업들이 주도할 경우 △개방형 소프트웨어 생태계를 그대로 차량으로 갖고 오는 경우 위 세 가지가 현재 가능성이 높은 경우의 수다.

.jpg)

OEM이 주도하는 경우 기존 산업 생태계에서 큰 변화가 없고 사고 시 확실하게 책임소재를 물을 수 있다는 장점이 있으나, 현대차그룹 외에 새로운 OEM의 설립과 성장이 국내에서는 불가능할 수 있다는 단점도 존재한다.

구글과 같은 성격의 기업이 주도할 때에는 서비스의 개발 환경과 지원이 상당 부분 개선될 수 있을 것으로 기대를 모으나, 핸드폰 시장과 같이 안드로이드에 종속될 수 있고 수익이 불확실해질 수 있다는 불안감도 있다.

개방형 생태계는 매력적인 OS 플랫폼의 시스템으로 적용될 가능성이 높다고 예측된다.

높은 자유도를 바탕으로 ICT SW 기업들이 산업으로 들어오며 시장의 다양한 요구를 수용할 수 있을 것이라는 최대 장점을 가지나 성장이 유망한 만큼 큰 규모의 신규투자가 필요하며 기존 생태계와의 경쟁도 피할 수 없다는 위험성도 수반한다.

SDV로 인해 부품 기업들은 가지고 있는 영역들이 축소되거나 없어질 수 있으며, 기존 기업들이 가지고 있었던 소프트웨어 개발을 통해 가지고 가져오던 이익들도 상당 부분 감소할 가능성이 있다고 곽 부문장은 이야기했다.

전동화의 흐름으로 부품 수가 줄어 역경을 걷고 있는 자동차 부품사들에게 SDV의 파도는 더욱 가혹할 수 있다.

기계 장치와 일체화된 소프트웨어에서 플랫폼 기반의 독립 소프트웨어로 변화하고, 시스템 설계와 구성 또한 OEM의 전장 플랫폼에 종속되어 부품 기업의 비교 우위가 약해질 수 있다.

이는 부품 기업의 입지를 흔들 것으로 예상되며 자체적인 소프트웨어 개발에서 오는 이익도 상당 부분 감소할 것으로 점쳐진다.

SDV 관련 임베디드 소프트웨어를 구현할 수 있는 인력을 신규채용하거나 자동차 산업 규격을 만족하고, 기업별 하드웨어 플랫폼과 연계 가능한 중립적인 소프트웨어 플랫폼을 보급하여 SDV 흐름에 동참하는 것이 기업에 생존에 있어 중요한 전환점이 될 것으로 보인다.

부품 기업들이 개방형 생태계로 나갔을 때 새로운 기회가 제공될 수도 있다는 밝은 미래도 분명하다.

기존 자동차 산업을 넘어 로봇, 배송, UAM 같은 새로운 항공 분야까지도 부품을 비롯한 소프트웨어로 진출할 수 있을 것으로 곽 부문장은 내다봤다.

.jpg)