SK하이닉스가 2025년 1분기 역대 두 번째로 높은 분기 매출과 영업이익을 기록하며, 과거와 달라진 경쟁력을 입증했다. SK하이닉스는 24일 2025년 1분기 잠정실적을 공시했다. 연결재무제표 기준으로 매출은 17조6,391억원으로 전년동기대비 41.9% 증가했고, 영업이익 7조4,405억원(영업이익률 42%)으로 전년동기대비 157.8% 증가했다. 당기순이익은 8조1,082억원(순이익률 46%)으로 전년동기대비 323% 증가했다.

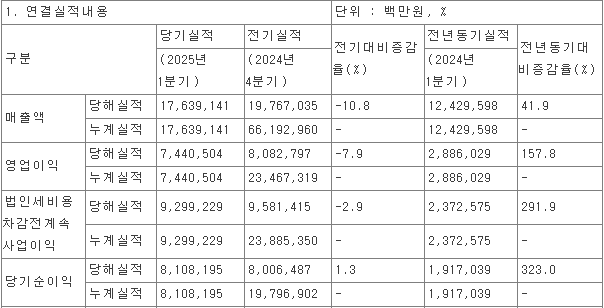

▲SK하이닉스 2025년 1분기 실적(연결재무제표기준)

매출 17조6,391억 전년比 42% ↑·영업이익 8조1,082억 전년比 323% ↑

SK하이닉스가 2025년 1분기 역대 두 번째로 높은 분기 매출과 영업이익을 기록하며, 과거와 달라진 경쟁력을 입증했다.

SK하이닉스는 24일 2025년 1분기 잠정실적을 공시했다.

연결재무제표 기준으로 매출은 17조6,391억원으로 전년동기대비 41.9% 증가했고, 영업이익 7조4,405억원(영업이익률 42%)으로 전년동기대비 157.8% 증가했다. 당기순이익은 8조1,082억원(순이익률 46%)으로 전년동기대비 323% 증가했다.

이번 매출과 영업이익은 분기 기준으로 역대 최고 실적을 달성했던 지난 분기에 이어 두 번째로 높은 성과다. 영업이익률도 전 분기 대비 1%p 개선된 42%를 기록하며 8개 분기 연속 개선 추세를 이어갔다.

SK하이닉스는 “1분기는 AI 개발 경쟁과 재고 축적 수요 등이 맞물리며 메모리 시장이 예상보다 빨리 개선되는 모습을 보였다”며 “이에 맞춰 HBM3E 12단, DDR5 등 고부가가치 제품 판매를 확대했다”고 설명했다.

이어 “계절적 비수기임에도 과거와 확연히 달라진 당사 경쟁력을 입증하는 실적을 달성했다”며 “앞으로 시장 상황이 조정기에 진입하더라도 차별화된 실적을 달성할 수 있도록 사업 체질 개선에 더욱 매진하겠다”고 강조했다.

이 같은 실적 달성에 힘입어 1분기 말 기준 회사의 현금성 자산은 14조3,000억원으로, 지난해 말보다 2,000억원 늘었다. 이에 따라 차입금과 순차입금 비율도 각각 29%와 11%로 개선됐다.

SK하이닉스는 글로벌 불확실성 확대로 수요 전망의 변동성이 커지고 있다며, 이러한 환경 변화에도 고객 요구를 충족시킬 수 있도록 공급망 내 협력을 강화하기로 했다.

회사는 HBM 수요에 대해 고객과 1년 전 공급 물량을 합의하는 제품 특성상 올해는 변함없이 전년 대비 약 2배 성장할 것으로 내다봤다. 이에 HBM3E 12단 판매를 순조롭게 확대해 2분기에는 이 제품의 매출 비중이 HBM3E 전체 매출의 절반 이상이 될 것으로 전망했다.

또한 AI PC용 고성능 메모리 모듈인 LPCAMM2를 올해 1분기부터 일부 PC 고객에게 공급했고, AI 서버용 저전력 D램 모듈인 SOCAMM은 고객과 긴밀히 협업해 수요가 본격화되는 시점에 공급을 추진할 계획이다.

낸드에서도 회사는 고용량 eSSD 수요에 적극 대응하는 한편, 신중한 투자 기조를 유지하며 수익성 중심의 운영을 지속할 방침이다.

SK하이닉스 김우현 부사장(CFO)은 “‘설비투자 원칙(Capex Discipline)’을 준수하며 수요 가시성이 높고 수익성이 확보된 제품 중심으로 투자효율성을 한층 더 강화할 것”이라며 “AI 메모리 리더로서 파트너들과 협력을 강화하고 기술 한계를 돌파해, 업계 1등 경쟁력을 바탕으로 한 지속적인 이익 창출을 위해 노력하겠다”고 말했다.